social security tax limit

There is a limit on the amount of your annual earnings that can be taxed by Social Security called the maximum taxable earnings. In 2021 the maximum amount of income subject to the Social.

Social Security Programs Rates Limits Updated For 2019 Scott Company Columbia Sc Accounting Firm South Carolina Cpa

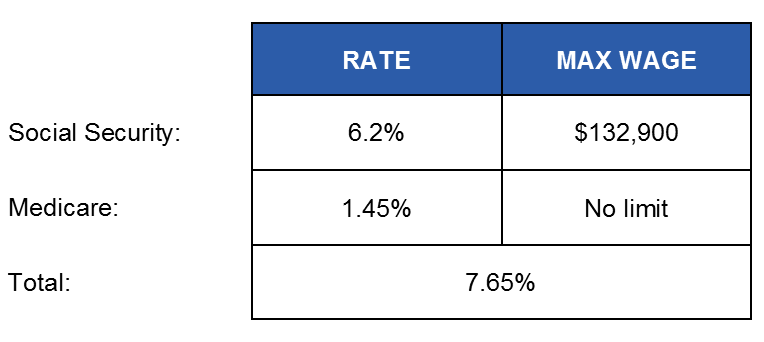

The tax rate for 2022 earnings sits at 62 each for employees and employers.

. More than 44000 up to 85 percent of your benefits may be taxable. Up to 85 of a taxpayers benefits may be taxable if they are. SourGuavaSauce 2 min.

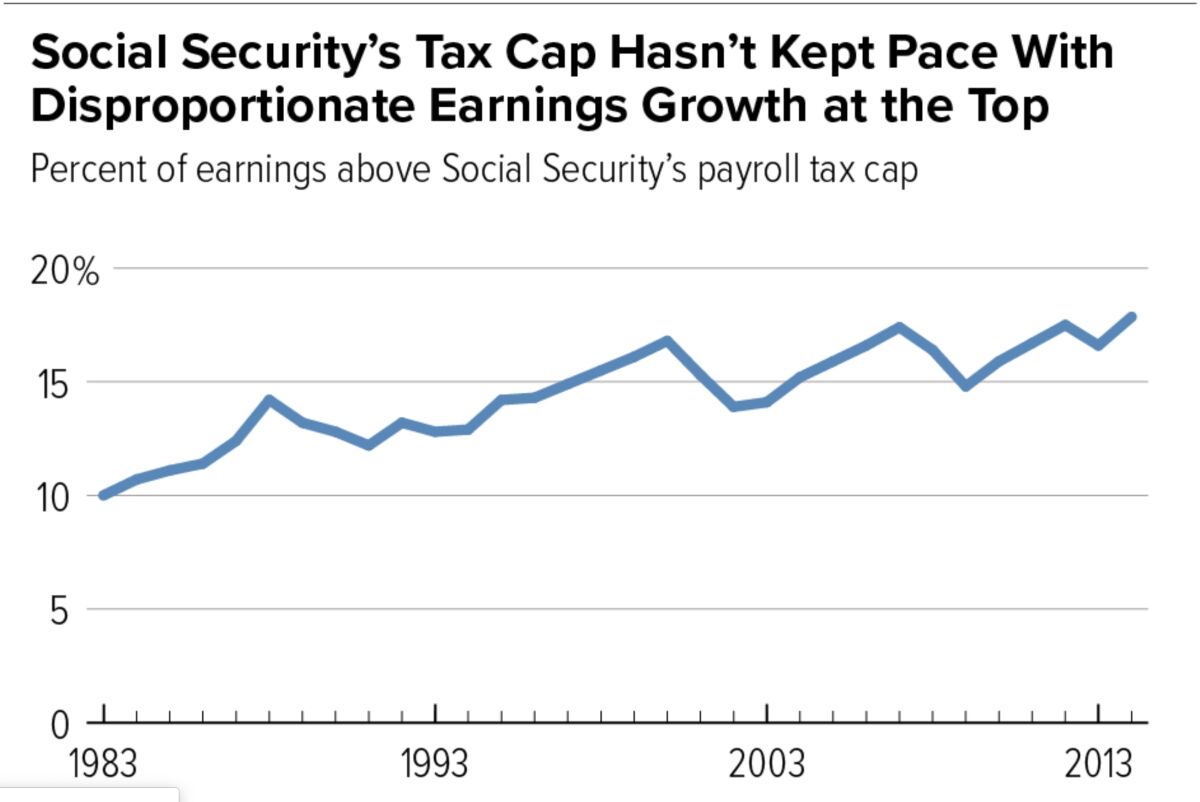

9 rows En español. Most people pay Social Security taxes on all of their income but this isnt true for high earners. There is a limit on the amount of annual wages or earned income subject to taxation called a tax cap.

Social Security tax is charged at a 62 rate and applies to all earned income up to the annual maximum mentioned in the previous section. The most you will have to pay in Social Security taxes for 2022 will be 9114. Its-a-write-off 2 hr.

Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits. If you are working there is a limit on the amount of your earnings that is. For taxes due in 2021 refer to the Social Security income maximum of 137700 as youre filing for the 2020 tax year.

For married couples filing jointly you will pay taxes on up to 50. Its very important to remember that in the year following this first year the monthly limit is no longer used and the. In 2022 you only pay these taxes on the first 147000 you make.

You may not need to pay Social Security tax on all of your earnings if you have a high salary. Filing single head of household or qualifying widow or widower with more than 34000 income. Thats what you will pay if you earn 147000 or more.

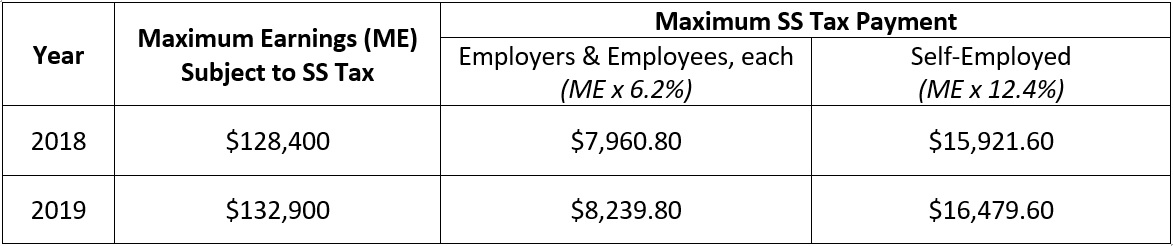

Workers pay into the Social Security system until their income reaches the Social. 1 2019 the maximum earnings that will be subject to the Social Security. I cant think of any others that go down after you got a refund limit.

Your taxes could jump. In this calendar year for 2023 the limit is 4710 112 of 56520. Among other things the AWI determines the maximum earnings subject to Social Security payroll taxes at a 124 percent rate.

Different rates apply for these taxes. The other taxes go up as income goes up. If your combined income is more than 34000 you will pay taxes on up to 85 of your Social Security benefits.

It is also the maximum amount of covered wages that are taken into account when average earnings are calculated in order to determine a workers Social Security benefit. This means that any income you. That limit will rise to 160200 in 2023 from.

If You Work More Than One Job It doesnt matter that. The 2021 tax limit is 5100 more than the 2020 taxable maximum of 137700 and 36000 higher than the 2010 limit of 106800. So individuals earning 147000 or more in 2022 would contribute 9114 to the OASDI program.

This so-called tax max increased from 147000. With the new wage base at 160200 high-income earners will pay a 62 Social Security tax on that amount if they are employed or 124 if they are self. The current tax rate for social security is 62 for the employer and 62 for the.

As its name suggests the Social. The taxable maximum was just 76200 in. The maximum Social Security tax employees and employers will each pay in 2019 is.

Social Security and Medicare Withholding Rates.

81 Years Of Social Security S Maximum Taxable Earnings In 1 Chart The Motley Fool

Federal Insurance Contributions Act Wikipedia

Social Security Announces 2022 Adjustments Conway Deuth Schmiesing Pllp

What Is The Social Security Tax Limit For 2022

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

The Social Security Tax Limit For 2022 And How It Works Explained The Us Sun

Who Pays If We Raise The Social Security Payroll Tax Cap Center For Economic And Policy Research

2022 Social Security Tax Limit Everything You Need To Know

Social Security Tax Limit Wage Base For 2022 Smartasset

Over The Top Who Pays More If We Raise The Social Security Payroll Tax Cap Center For Economic And Policy Research

Column The Rich Have Already Paid All Their Social Security Tax Los Angeles Times

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

Social Security Tax Limit For 2022 Explained Fingerlakes1 Com

Social Security Tax Limit 2022 And Exemptions Explained

Column The Rich Have Already Paid All Their Social Security Tax Los Angeles Times

What Is The Maximum Social Security Tax For 2015 The Motley Fool

Avoiding The Social Security Tax Trap Barron Financial Group Llc